The M&A Headache: Solving the "Two-App Problem" with a Federated Mini-App Strategy

Introduction: The "Day 1" Integration Crisis

Mergers and Acquisitions (M&A) are the fastest way to grow a business, but they are also the fastest way to break a tech stack.

Picture the scenario: Company A (The Acquirer) buys Company B (The Target) for $500 million. The press release promises "Immediate Synergies" and a "Unified Customer Experience." The deal closes. Champagne is popped.

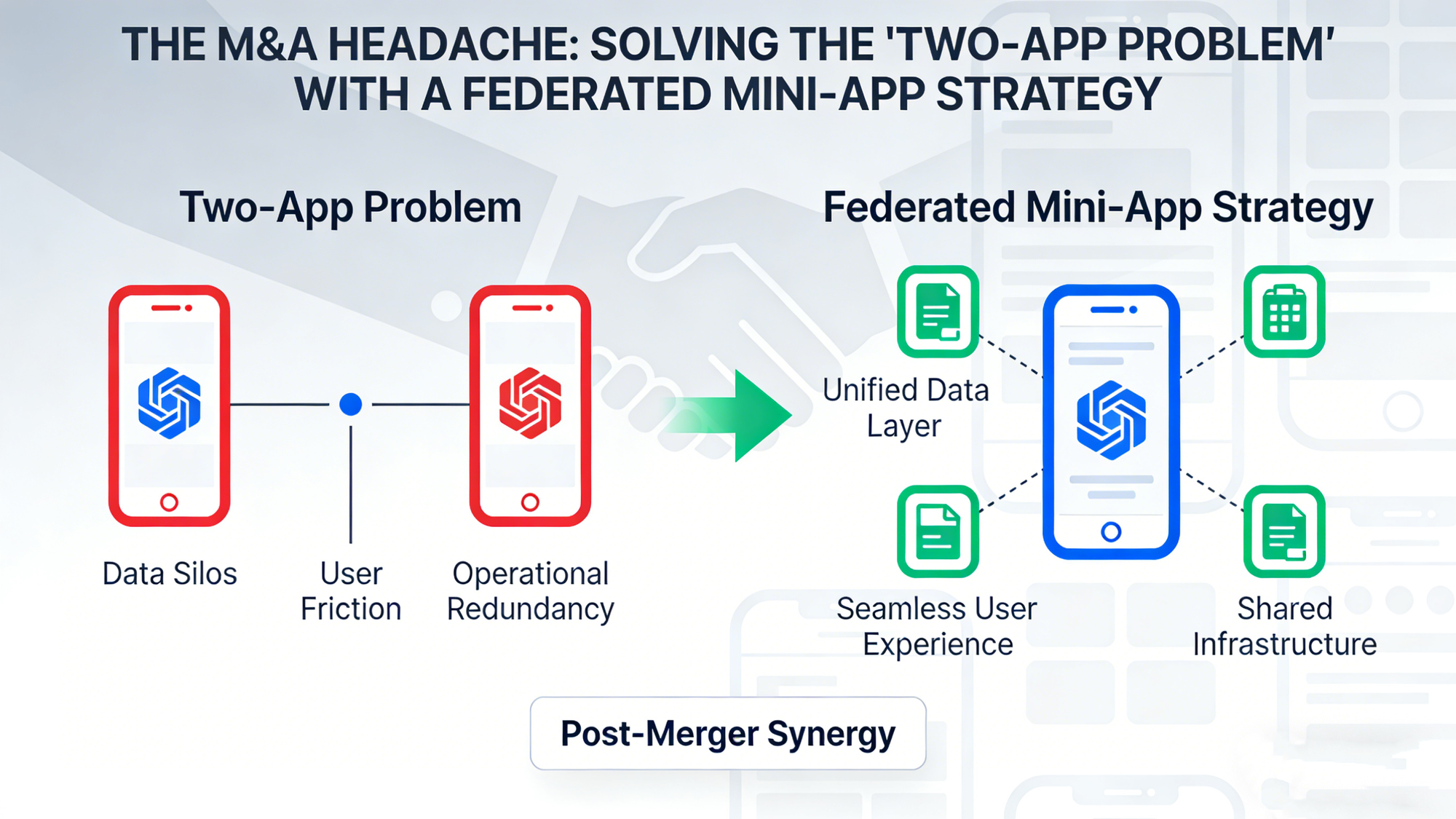

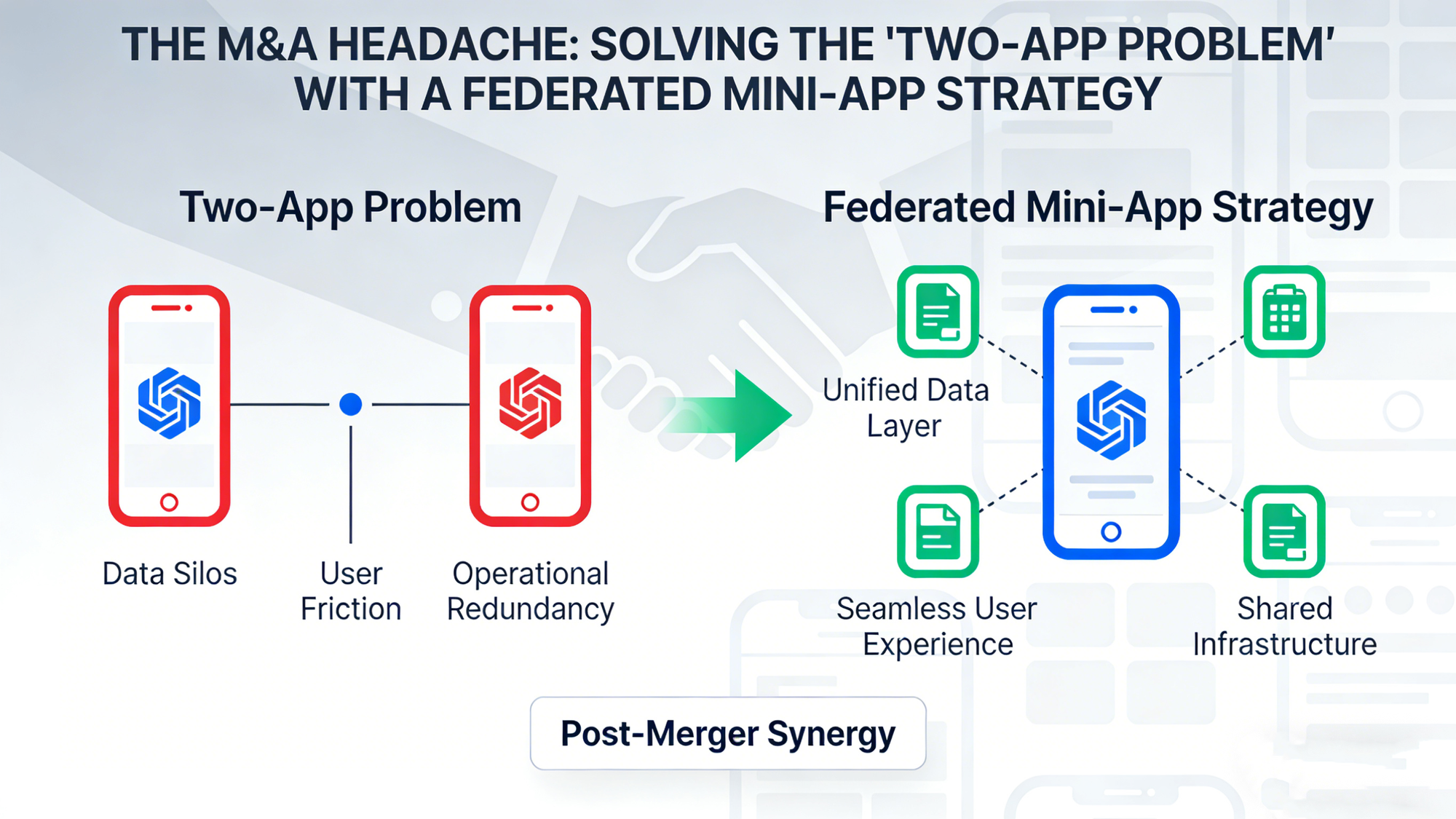

Then, the CIO wakes up to the "Two-App Problem."

- Company A has a monolithic native app with 5 million users.

- Company B has a different native app (different tech stack, different backend) with 1 million loyal users.

Now, the integration team faces three bad options:

- The "Kill" Option: Shut down App B and force users to download App A. Result: Massive customer churn. Users loved Brand B for a reason; they resent being forced to migrate.

- The "Rewrite" Option: Rebuild App B’s unique features inside App A’s codebase. Result: An 18-month roadmap. By the time it’s done, the market has moved on.

- The "Parallel" Option: Keep both apps running separately forever. Result: Double the maintenance cost, split data silos, and zero synergy.

In 2026, there is a fourth option. It is called Federated Integration, and it is powered by FinClip Mini-App Containers.

This strategy allows you to merge capabilities without merging codebases, achieving the elusive "Day 1 Synergy" without the IT nightmare.

The Strategy: Decoupling Brand from Logic

The core philosophy of Federated Integration is simple: The App is just a Shell; the Business Logic is portable.

By installing the FinClip SDK into both App A and App B, you create a shared runtime environment. This allows you to treat business features (Loans, Rewards, Shopping Carts) as modular Mini-Apps that can flow freely between the two apps.

Here is how this plays out in two specific M&A strategies:

Strategy 1: The "Trojan Horse" (Cross-Selling to the Acquired Base)

Usually, Company A buys Company B to sell its core products to Company B's customers.

- Example: A National Bank buys a Niche Fintech app to sell Mortgages.

The Old Way:

The Bank puts a banner in the Fintech app: "Click here to apply for a mortgage on our website." The user clicks, leaves the app, hits a login wall on the web, and quits. Conversion rate: <1%.

The FinClip Way:

The Bank takes its existing "Mortgage Calculator & Application" Mini-App (running on FinClip) and deploys it dynamically into the Fintech App.

- User Experience: The Fintech user sees a new "Mortgage" icon. They tap it. The mini-app opens instantly inside the Fintech app.

- Data Flow: Because of the FinClip bridge, the mini-app automatically reads the user’s identity from the Fintech app. No login required.

- Result: The Bank sells mortgages to the new user base on Day 1, without rewriting the Fintech app’s source code.

Strategy 2: The "Harvest" (Porting Unique Features to the Parent)

Sometimes, Company A buys Company B because Company B has a killer feature.

- Example: A Retail Giant buys a boutique brand because they have an amazing "Virtual Try-On" feature.

The Old Way:

The Retail Giant’s engineers spend 9 months reading the boutique app’s source code, trying to reverse-engineer the "Try-On" feature and rewrite it in their own tech stack.

The FinClip Way:

The boutique brand wraps their "Try-On" feature as a FinClip Mini-App.

The Retail Giant publishes this mini-app to their own Super App.

- Result: The Retail Giant’s 50 million users get access to the "Virtual Try-On" feature immediately. The value of the acquisition is realized instantly across the entire ecosystem.

Technical Architecture: The Federation Layer

How does this work without creating a security mess? FinClip acts as the Federation Layer.

- Shared Marketplace: The Parent Company sets up a private FinClip Store. Both App A and App B connect to this store.

- Selective Distribution: You can configure the store so that the "Mortgage" mini-app appears in both apps, but the "Staff Admin" mini-app only appears in the internal employee app.

- Identity Mapping (Federated Identity): This is the crucial technical piece. FinClip provides the hooks to map User_ID_A to User_ID_B via a backend handshake. To the user, it feels like Single Sign-On (SSO). To the developer, it’s just a standard token exchange.

Operational Benefits: Speed as a KPI

In Post-Merger Integration (PMI), speed is the only metric that matters. The longer the integration drags on, the more talent and value you lose.

Using a Containerized strategy drastically improves PMI metrics:

- Time-to-Cross-Sell: Reduced from Months to Days. You don't need an App Store update to push a cross-sell mini-app; you just publish it to the container.

- IT Cost Reduction: You can eventually retire the backend of the acquired app while keeping its frontend "Shell" alive to retain the brand. The Shell simply loads mini-apps powered by the Parent Company’s backend. This is the "Strangler Pattern" applied to M&A.

- Cultural Harmony: You don't have to force the acquired engineering team to learn your legacy codebase immediately. They can continue building in their preferred stack (Web/JS), wrapping their output as mini-apps.

Conclusion: Don't Merge Apps, Merge Ecosystems

The era of "ripping and replacing" IT systems after a merger is over. It is too slow and too destructive.

Smart CIOs are moving towards a Federated Architecture. They keep the front-doors (the Apps) distinct to preserve brand loyalty, but they unify the living room (the Services) using FinClip.

By treating your applications not as monoliths, but as containers for shared business logic, you turn the "Two-App Problem" into a "Multi-Channel Opportunity." You unlock the value of your acquisition not in two years, but today.

Accelerate your M&A integration. Discover FinClip's Federated Ecosystem solutions.